The company was founded in 2001 by businessman Roni Nathanson and his family, who are currently residing in the U.S. The company was founded with the intent and purpose of finding a proper solution for one of Israeli businesses’ most predominant and commonplace problems – that of “bounced checks”.

Since its founding, the company has grown to become a leading company in Israel on payment obligations for payment methods, initially through check payment obligations and later also through obligations for the payment of invoices and account debit orders for its clients, who are businesses.

The Company’s CEO is Shai Perminger. As of 2022 the company has over 230 employees.

The company’s systems are deployed at approximately 15,000 points of sale across Israel.

In 2021, the company provided check payment obligation services at a scope of over NIS 4.5 billion, as well as a standing order payment obligation service at a scope of over approximately NIS 675 million.

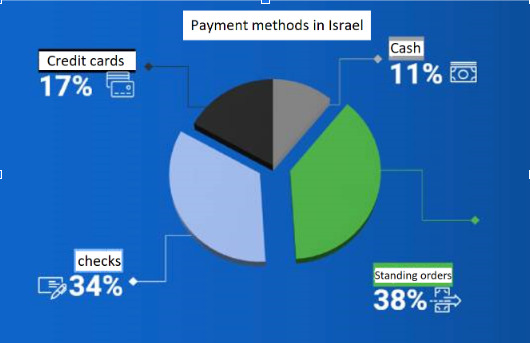

The payment methods industry in Israel

The payment methods industry in Israel is a developing, vast and diverse industry. A client’s payment options at a business are, among others, payment in cash (at the limit permitted by law), payment by checks, payment by standing order and payment by credit cards.

Today, approximately 34% of payments in Israel are made using checks, and in 2021 the total checks amounted to approximately NIS 811,691 billion.

38% of payments are today made using standing orders, and in 2021 the scope of payments by standing orders was NIS 894,378 billion.